The banking industry has undergone significant technological changes in recent years, with intelligent automation being one of the major contributors. Intelligent automation, which includes technologies such as Robotic Process Automation (RPA), Optical Character Recognition (OCR), and Business Process Automation (BPA), has the potential to improve operational efficiency, reduce errors, and enhance customer experience. In this blog post, we will explore some of the use cases of intelligent automation in the banking industry.

See How Bautomate Intelligent Automation Transforms Banking Industry

Account opening and KYC process

Problem: The account opening process in the banking industry is typically a time-consuming and manual process. It involves a lot of paperwork, including identity verification, proof of address, and other documents. This process can take days or even weeks to complete, leading to a poor customer experience.

Solution: By using intelligent automation, the account opening and KYC process can be streamlined and automated. OCR technology can be used to extract data from documents, and RPA can be used to input the data into the banking system. This process can be completed in a matter of minutes instead of days, improving the customer experience and reducing the risk of errors.

Research Statistic: According to a survey conducted by PwC, 78% of banking executives believe that the use of intelligent automation in customer onboarding processes will significantly improve the customer experience.

Loan processing & Underwriting

Problem: Loan processing is another manual and time-consuming process in the banking industry. It involves verifying customer information, credit scores, and other documents, which can be a tedious task for banking employees.

Solution: Intelligent automation can help streamline the loan processing process by using OCR technology to extract data from documents and RPA to input the data into the banking system. BPA can be used to automatically assess the creditworthiness of customers based on predefined criteria, reducing the time it takes to process loans.

Research Statistic: According to a survey conducted by McKinsey, intelligent automation can reduce loan processing times by 30-50%.

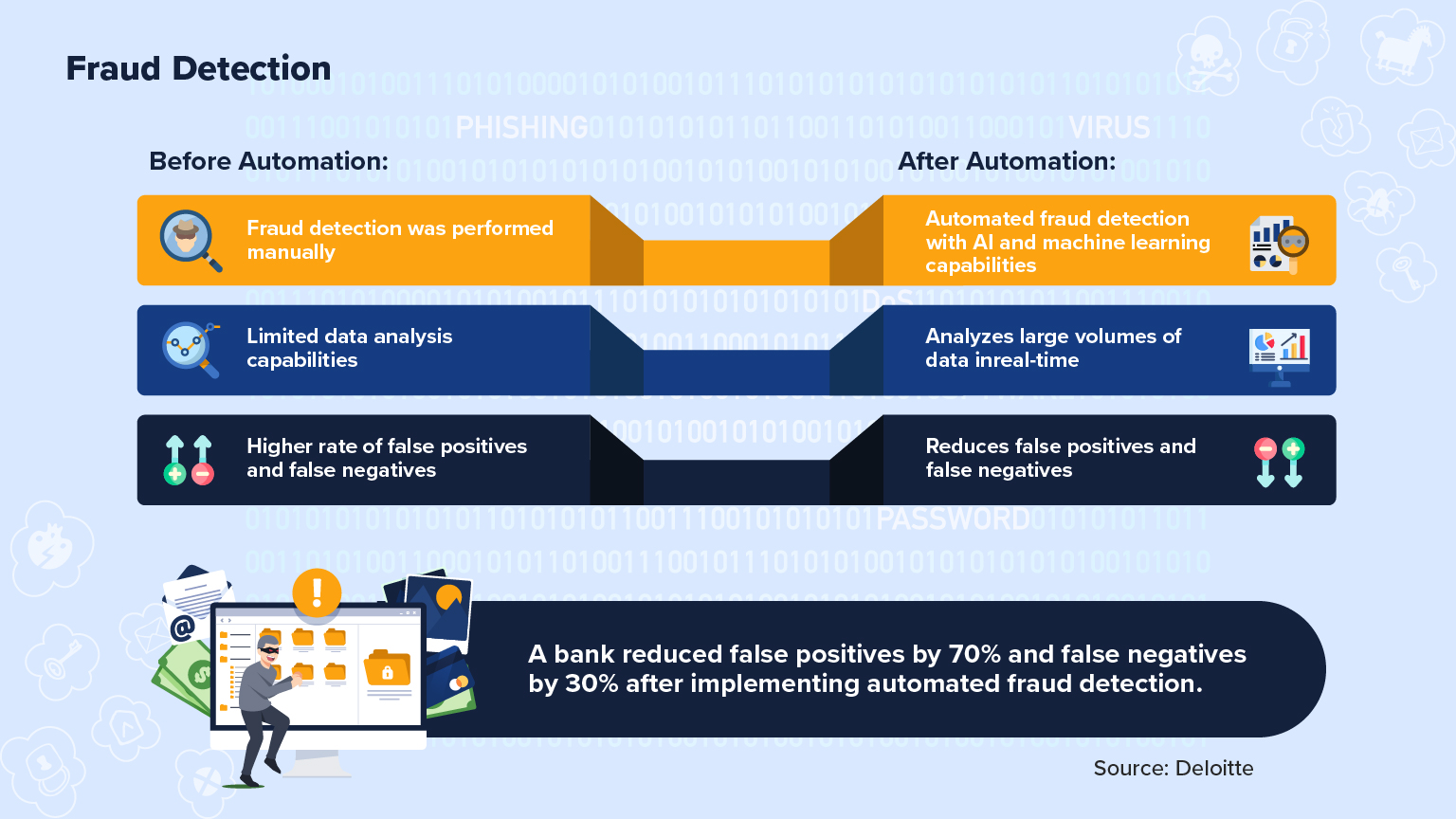

Fraud detection and prevention

Problem: Fraud is a significant issue in the banking industry, and detecting and preventing fraud is an essential task for banking employees. Fraudulent activities can result in significant financial losses for both the bank and its customers.

Solution: Intelligent automation can help detect and prevent fraud by using machine learning algorithms to analyze transaction data and identify patterns that indicate fraudulent activities. RPA can be used to automatically flag suspicious transactions and alert banking employees, reducing the risk of fraud and improving overall security.

Research Statistic: According to a survey conducted by Accenture, intelligent automation can reduce the cost of fraud detection by up to 60%.

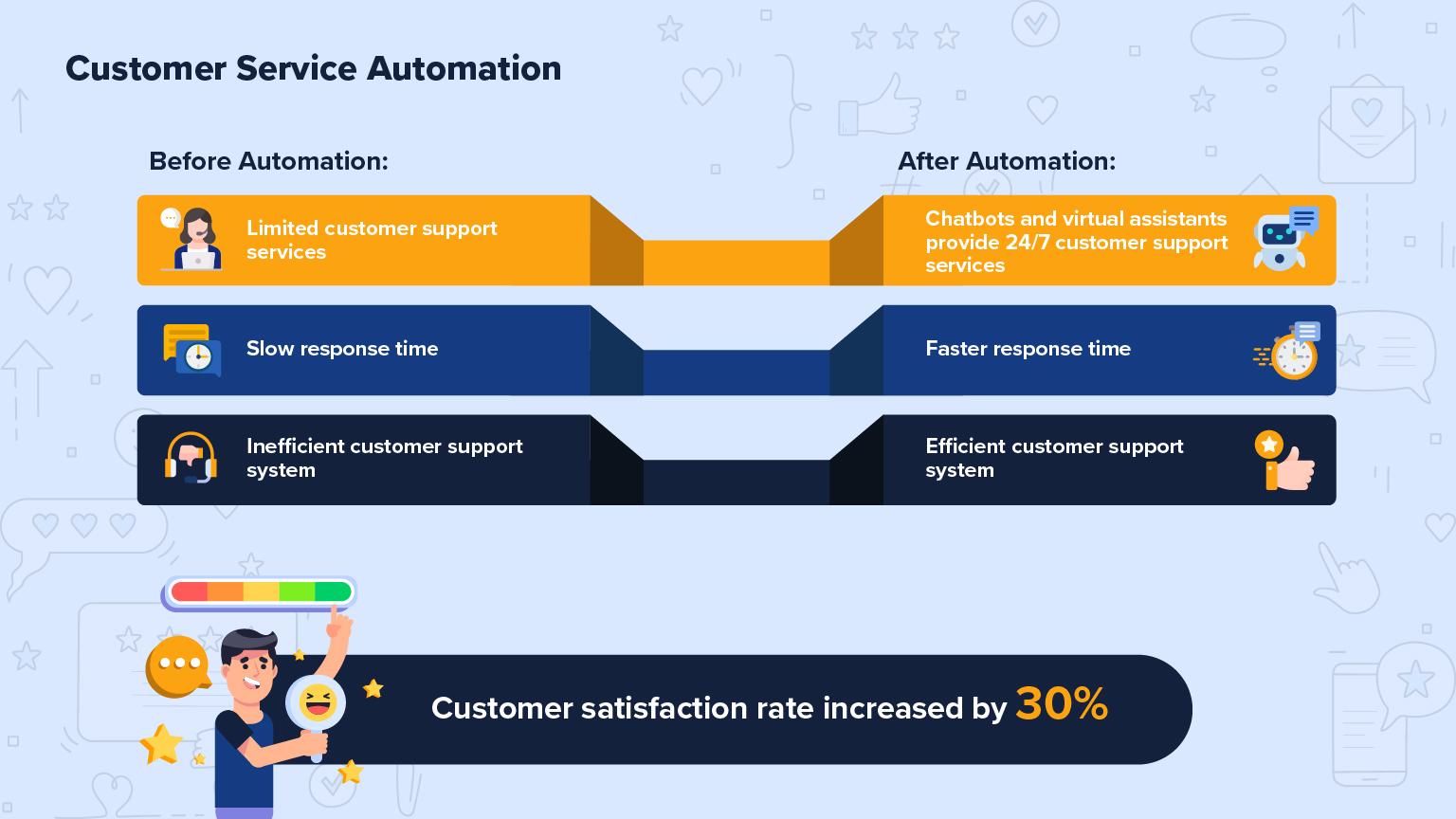

Customer service

Problem: Customer service is a critical component of the banking industry, but it can be challenging to provide high-quality customer service 24/7. With many customers accessing banking services online, there is a need to provide round-the-clock support.

Solution: Intelligent automation can help improve customer service by using chatbots and virtual assistants to provide 24/7 support to customers. These chatbots can be trained to answer common customer queries and provide personalized assistance based on customer data, improving the overall customer experience.

Research Statistic: As per a report by Juniper Research, chatbots are expected to save banks over $7.3 billion in customer service costs by 2023.

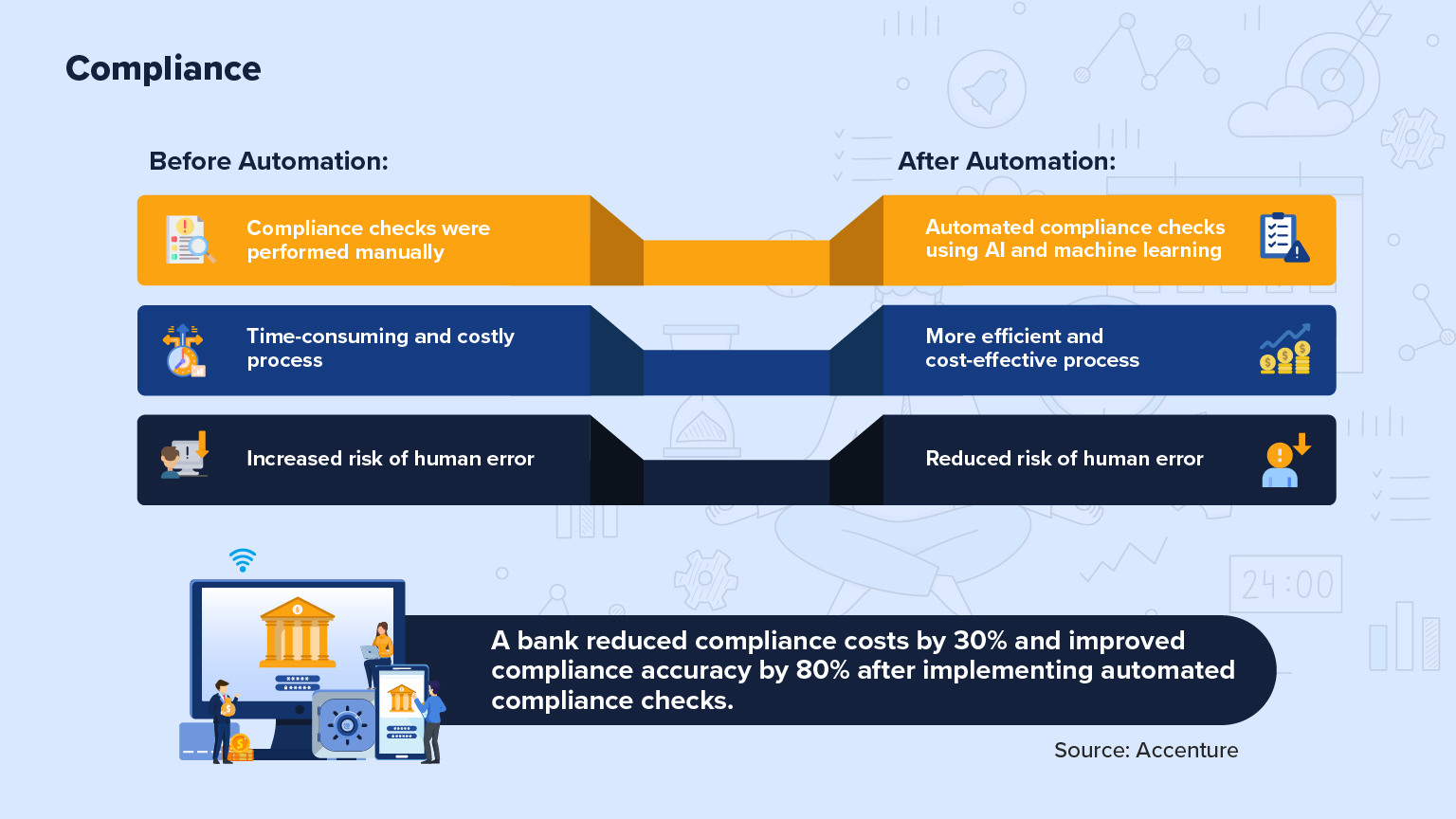

Compliance Management

Problem: The banking industry is subject to various regulatory requirements, and compliance management is a critical challenge for banks. Compliance management involves several manual processes that are time-consuming, error-prone, and expensive.

Solution: RPA can automate compliance management by automatically monitoring transactions, identifying suspicious activities, and generating reports. OCR can extract data from regulatory documents, and BPA can automate compliance workflows. This automation technology can improve compliance efficiency, reduce costs, and improve regulatory compliance.

Research Statistic: According to a survey conducted by Deloitte, 82% of banking executives believe that intelligent automation can help banks to meet regulatory compliance requirements more efficiently.

Conclusion

Intelligent automation has significant potential in the banking industry, and the use cases mentioned above are just a few examples of how it can be leveraged to improve operational efficiency, reduce errors, and enhance customer experience. By using technologies such as RPA, OCR, and BPA, banks can streamline their processes, reduce costs, and stay ahead of the competition.

Bautomate has many interesting use cases encapsulated with OCR, BPA, RPA technology that could optimize your business performance, save costs and boost growth. Find out how Bautomate’s use cases can apply to your product. Get Started