Accounts Payable (AP) automation has been gaining traction in recent years, especially in the financial services industry to improve efficiency, reduce costs, and mitigate risks. With the volume of invoices and expense reports continuing to grow, manual AP processes are becoming cumbersome. Automation solutions help financial service firms streamline AP operations through advanced technologies like optical character recognition (OCR), document extraction, and approval workflows.

In this blog post, we will discuss the trends and best practices for AP automation in the financial services industry.

Key Trends In Accounts Payable Automation

Cloud-based Solutions:

Cloud-based solutions are becoming increasingly popular for AP automation. This is because it offers greater flexibility, scalability, and accessibility. It requires less infrastructure and maintenance compared to on-premise solutions.

Integration with ERP Systems:

AP automation solutions can be integrated with Enterprise Resource Planning (ERP) systems to provide end-to-end automation. This integration allows for the seamless transfer of data between systems, reducing the risk of errors, increasing efficiency and providing better visibility into financial data.

Machine Learning and AI:

Machine learning and AI are used to automate the invoice matching process, reducing the need for manual intervention. AI-powered solutions can also identify patterns in payment data to detect fraud and minimize risks.

Data Analytics:

Data analytics is becoming increasingly important in AP automation. Advanced analytics capabilities can help financial firms identify trends, uncover insights, and make data-driven decisions.

Best Practices For Ap Automation In The Financial Industry

Standardize AP processes:

Standardize AP processes to ensure consistency and accuracy. Create a set of guidelines and procedures that all employees must follow when processing invoices, approving payments, and handling exceptions.

Choose the right AP automation solution:

Select an AP automation solution that meets the unique needs of your financial business. Look for a solution that integrates with your existing systems, offers a user-friendly interface, and provides advanced reporting and analytics capabilities.

Ensure compliance with regulations:

The financial industry is heavily regulated, and AP automation solutions must comply with regulations. Ensure that your AP automation solution complies with all relevant regulations.

Implement strong security measures:

The financial industry is a prime target for cyberattacks, and AP automation solutions must have strong security measures to protect against fraud and data breaches. Implement multi-factor authentication, encryption, and other security measures to protect sensitive financial data.

Optimize payment workflows:

Streamline payment workflows to reduce delays and improve efficiency. Use automated workflows to route invoices and approvals to the appropriate individuals, and set up alerts and notifications to keep everyone informed.

Monitor AP performance:

Monitor and measure your AP performance to identify areas for improvement. Use KPIs such as invoice processing time, payment accuracy, and exception rates to track your progress.

Continuous improvement:

Continuously improve your AP automation processes by regularly reviewing and analyzing your performance metrics. Identify areas for improvement and implement changes to optimize your processes.

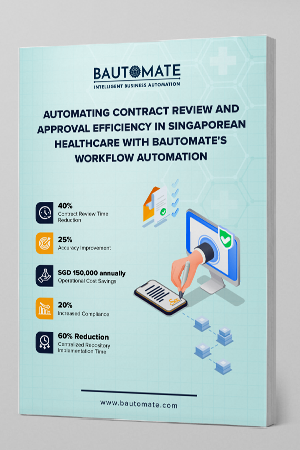

Transform Your Financial Operations With Bautomate

With Bautomate’s AP automation solution, financial firms can seamlessly automate invoice processing and payment approval workflows.Real-time visibility into the payment process allows you to easily track invoices, payments, and exceptions. It can be integrated with your existing ERP systems, providing advanced reporting and analytics capabilities. Additionally, our solution uses strong security measures to protect sensitive financial data and comply with regulations. By implementing our AP automation solution, financial firms can streamline their payment processes, reduce costs, and improve their overall financial management.

Get connected with us now!