Say goodbye to manual document handling, embrace our AI-powered solution that simplifies, scales, and adapts, and Experience the Future of Document Processing.

Leverage Bautomate’s advanced automation engine with features tailored specifically to streamline your document analysis and processing:

Transform raw data into actionable insights with Bautomate’s Contextual Data Extraction capabilities:

Bautomate’s Copilot and AI Agent capabilities empower businesses with pre-trained AI models optimized for various industries:

Reduce payment errors and accelerate financial closures with our intelligent invoice capture, built-in approvals, and automated reminders, your team spends less time on paperwork and more on strategy. Bautomate is capable of extracting data from both scanned and digital documents, detecting duplicates, and even routing approvals via email for faster turnaround.

Reduction in

workload

Fewer

payment errors

Quicker financial

closures

Automate your invoice data capture process in any format using AI and ML technologies namely OCR. With invoice capture, the employees scan invoices as they arrive. Extract the captured data using OCR from physical documents so it can be imported directly into the account payable system eliminating double entry and reducing human error.

The AP department is automated to ensure that all invoices are sent to a single location, to prevent the invoices from being duplicated. Duplicate invoices are automatically detected in accordance with the different attributes of the invoice such as the invoice number, bank account, date and amount.

Payment reminders and invoices are sent in advance to ensure the suppliers receive the payments on time without delay. Apart from sending reminders to the clients for the payment due, automatic reminders help clear invoicing errors.

Any invoices stored in the system can be easily identified as it gives complete control over invoices and related data. Finance staff and approvers take advantage of simple and advanced features to obtain the exact information required.

With the power of OCR, the invoice is captured and the data is extracted for further processing. It recognizes the machine printed checklist forms by converting data into digital format.

Approval invoices are sent automatically via email, ensuring accuracy and legitimacy. Digitising invoice approvals and reminders cuts down the extra hurdles, streamlining the workflow for the AP team to process payments more quickly.

Reduced

Workload

Increased

Profitability

Lower Processing

Costs

Standard invoices are processed automatically. Auto content validation and rule-based checks mean your team only steps in when needed.

AP automation streamlines invoice approvals by automatically routing invoices to the right stakeholders based on predefined rules. Approvers receive instant notifications, can review invoices digitally, and approve them with one click — reducing delays and eliminating approval bottlenecks. It ensures consistency, speeds up cycle times, and gives AP teams full visibility into the status of each invoice.

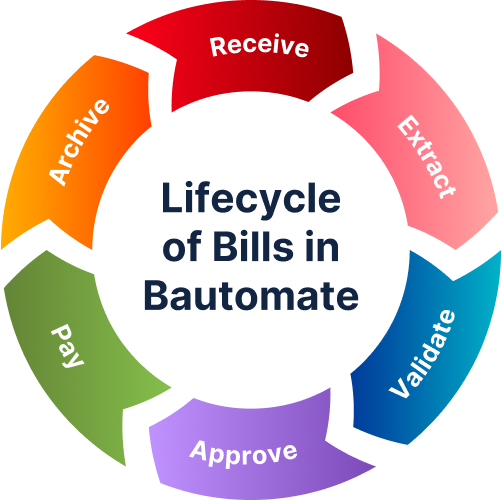

Invoice automation digitizes the entire document lifecycle — from receipt to archiving. All invoices (paper or digital) are captured, organized, and stored in a centralized system, making them easy to search, retrieve, and audit. This eliminates paper clutter, prevents lost documents, and ensures secure, compliant document retention.

The system automatically scans for duplicate invoice numbers, amounts, and supplier details before processing. It flags potential duplicates in real time and blocks them from moving forward until verified. This built-in validation helps avoid costly overpayments and improves financial accuracy.

Yes. AP automation enforces strict validation rules, approval workflows, and role-based access controls, making it difficult for fraudulent invoices to slip through. It checks for mismatched data, irregular vendor details, and unauthorized changes — significantly reducing the risk of internal or external invoice fraud.

Absolutely. Bautomate supports supplier-facing features such as self-service invoice submission, status tracking, and automatic acknowledgments. Suppliers can submit invoices digitally and get real-time updates on approval or payment status, reducing back-and-forth communication and improving vendor relationships.

Manual invoicing is time-consuming, error-prone, and costly. Automating the invoicing process helps eliminate data entry mistakes, reduce approval delays, prevent duplicate payments, and ensure compliance. With automation, businesses gain speed, accuracy, and real-time visibility — freeing AP teams to focus on more strategic financial tasks instead of chasing paper and emails.

Traditionally, manual invoice processing can take 10–15 days per invoice, depending on volume and complexity. With Bautomate’s AI-powered invoice automation, this can be reduced to 1–3 days or even hours, thanks to instant data capture, automated approvals, and seamless ERP integration. The result is faster payments, fewer bottlenecks, and better supplier relationships.

Invoice automation streamlines the entire workflow — from invoice receipt to final payment. It eliminates redundant tasks like data entry, manual matching, and chasing approvals. Teams can set rules, track statuses in real time, and process invoices with minimal oversight. This not only speeds up operations but also improves internal accountability, accuracy, and financial control.

Invoice automation helps your business by reducing operational costs, shortening payment cycles, and minimizing errors. It improves cash flow visibility, ensures timely vendor payments, and scales easily with growing invoice volumes. Whether you’re handling hundreds or thousands of invoices, automation helps your finance team work smarter, make faster decisions, and stay audit-ready — all while saving time and money.

Bautomate’s Intelligent Hyper-Automation platform revolutionizes account reconciliation by eliminating manual effort, improving accuracy, and accelerating processing time. Unlike traditional, spreadsheet-driven methods that rely heavily on human intervention, Bautomate uses Generative AI, Machine Learning, and contextual data extraction to automatically match transactions, flag discrepancies, and route approvals. This results in faster month-end closures, fewer errors, and complete audit transparency — all while reducing operational overhead.

Enterprise Connectors allow Bautomate to integrate seamlessly with leading ERP systems, banking platforms, and accounting tools. This ensures real-time data synchronization and eliminates the need for manual data imports or exports. With a direct, secure connection between your financial systems and the reconciliation engine, the process becomes faster, more consistent, and far less error-prone — allowing your AP team to reconcile at scale with confidence.

Copilot acts as your intelligent assistant during the reconciliation process. It helps configure custom rules, suggests optimal workflows, and assists with resolving flagged discrepancies by offering contextual recommendations. Instead of manually investigating every exception, users can lean on Copilot to identify the best course of action, reducing resolution time and improving process consistency across teams.

AI Agents work behind the scenes to continuously analyze transactional data, learn from past reconciliation outcomes, and improve matching logic over time. They proactively identify recurring mismatch patterns, auto-categorize exceptions, and support predictive reconciliation by anticipating discrepancies before they occur. This self-improving intelligence reduces the manual workload and enhances the system’s performance with each cycle

Bautomate’s advanced analytics deliver real-time visibility into reconciliation status, financial accuracy, and team performance. With custom dashboards and line-level reporting, finance leaders can track KPIs, detect bottlenecks, forecast risks, and make informed decisions faster. These insights turn reconciliation from a reactive task into a strategic function — helping organizations improve control, compliance, and financial agility.