Advanced analytics and AI can help insurers analyze large amounts of data and make more informed decisions about risk assessment, pricing, and fraud detection.

Hyperautomation can help insurers quickly respond to changing market conditions & customer needs, and allow them to rapidly test & implement new products & services.

Advanced analytics and machine learning can help insurers better predict and prevent losses, and improve their overall risk management strategies.

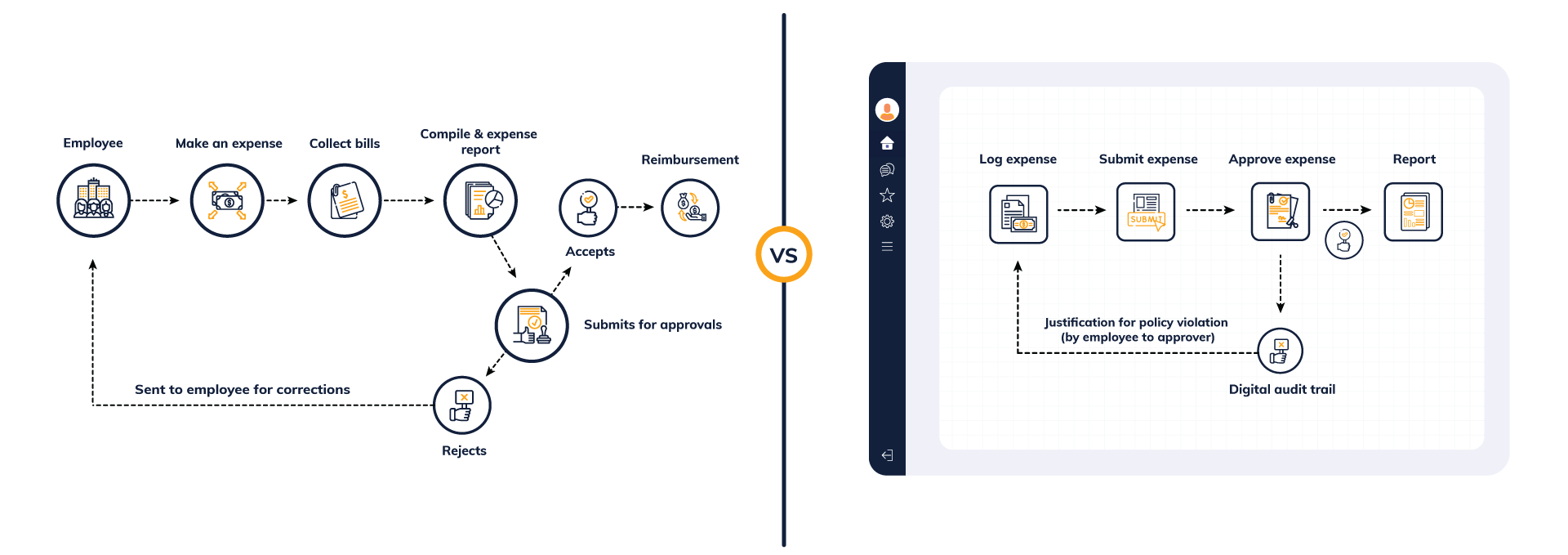

Hyperautomation can help insurers streamline and optimize their processes, leading to increased efficiency and cost savings.

Advanced analytics and AI can help insurers analyze large amounts of data and make more informed decisions about risk assessment, pricing, and fraud detection.

Hyperautomation can help insurers quickly respond to changing market conditions & customer needs, and allow them to rapidly test & implement new products & services.

Advanced analytics and machine learning can help insurers better predict and prevent losses, and improve their overall risk management strategies.

Hyperautomation can help insurers streamline and optimize their processes, leading to increased efficiency and cost savings.

Reduction in internal processing time

Reduction in end-to-end cycle times

Improvement in SLA for Front Line Phone calls

Automation helps in streamlining claim related processes. It helps in improving customer satisfaction by processing complaints quickly and also reduces costs related to fraud with AI driven fraud detection.

Information from application documents are processed and extracted using OCR technology. These applicant documents are filed in a centralized repository with high security.

Automating know your customer process can be reduced from hours to seconds, freeing the business from lengthy and costly processes. Insurance companies can identify documents and automatically cross-reference applications with third-party databases.

The management of all the policy related processes requires a great deal of manual labour. Automation of these processes helps to classify documents and reports, extract relevant data, and inform policyholders with all the necessary information.

Insurance companies usually adhere to strict regulations that may change frequently. Automating the manual process such as name screening, generating reports, etc enables enhanced data accuracy and eliminates the authorized access.

With ready to deploy features, automation simplifies complex insurance processes like risk assessment with pre-built and plug-and-play integrations.

BPA with AI capability can analyze large volumes of data and deal with exceptions and translate them into insights to take actions. BPA can go beyond just cost reduction and efficiency by adding significant value to businesses with personalization and higher degree of self-service.

Although the insurance sector is heavily regulated and reluctant to innovate, its clients are frequently the polar opposite. The modern insurance customer moves more quickly than ever before. Poor service and extended wait times can harm impact on your business. Finding strategies to evolve and keep up with the pace of the clients is beneficial to all insurance companies. RPA will help you do just that!

Where we share our thoughts, insights, and expertise on Automation that are important to our readers

You cannot copy content of this page